EDITOR'S NOTE

Marie Pégoud-Féjoz

Content Lead,

Commodities People

Welcome to the latest edition of the Commodity Trading Insider!

This month’s theme ‘Digitalisation in Commodities: An Outlook on What’s Ahead', explores how technology is reshaping commodity markets in practical and measurable ways.

From forecasting power grid loads and modelling outages to analysing drought risk in grain trading, digital tools are becoming embedded in day-to-day trading, analytics, and risk functions. Firms are moving beyond surface-level AI conversations and focusing on how data, automation, and intelligent systems support pricing, execution, and risk visibility.

In this edition, we examine how trading organisations are structuring their digital roadmaps for the next 12 months. With insights across trade finance, IT governance, GenAI, and the continued evolution of CTRM systems, we look at how market participants are strengthening data capability and aligning technology with commercial performance in an increasingly complex market environment.

EDITOR'S PICKS

Technology leaders panel – Developing digital roadmaps for the next 12 months and beyond

Embracing change for better IT governance & compliance over financial reporting

The digital shift in agri-commodity trading—An interview with GAFTA’s Jaine Chisholm Caunt OBE

Digitalising trade finance: Standards, framework and tools to optimise assessments and processes

Technologies transforming risk management: Innovations, challenges, and opportunities

TOP RATED

LATEST NEWS

Commodity Trading Industry Report 2025

The 2025 Commodity Trading Report brings together insights from over 7,000 professionals across the global commodity ecosystem. Drawing on engagement from major events in London, Stamford, and Singapore, the report explores key trends in trading, risk management, technology, compliance, and sustainability, offering a timely snapshot of industry challenges, opportunities, and ...

Driving Financial Excellence with Openlink: New capSpire White Paper

In this expert-led white paper, capSpire reveals proven methods to elevate financial performance through smarter system configuration, automation, and integration.

The Next-Gen of Intelligence For Commodity Trading Desks

Alternative data is reshaping commodity trading. From power grid loads and drought forecasts to fast-moving operational signals, discover how traders turn messy, unconventional datasets into real insight. Explore the analytics, machine learning and intelligence pipelines powering next-generation decision-making, and learn why some firms convert data into alpha while others remain ...

The Path Forward: Strategy, CTRM Evolution and Digital Resilience

Next-generation CTRMs are becoming the digital engine of trading. Discover how modular, AI-enabled platforms are transforming pricing, hedging, risk and compliance, while creating a single source of truth across power, gas, metals and renewables. Learn how leading firms integrate predictive analytics, automate decision-making and embed sustainability, building resilient, future-ready trading ...

From Electrons to Minerals: How GenAI Is Reshaping Mining, Resources & Talent

An interview with WIMAR SG and Commodities People on how generative AI, inclusive leadership, and human judgement are shaping the future of the resources sector.

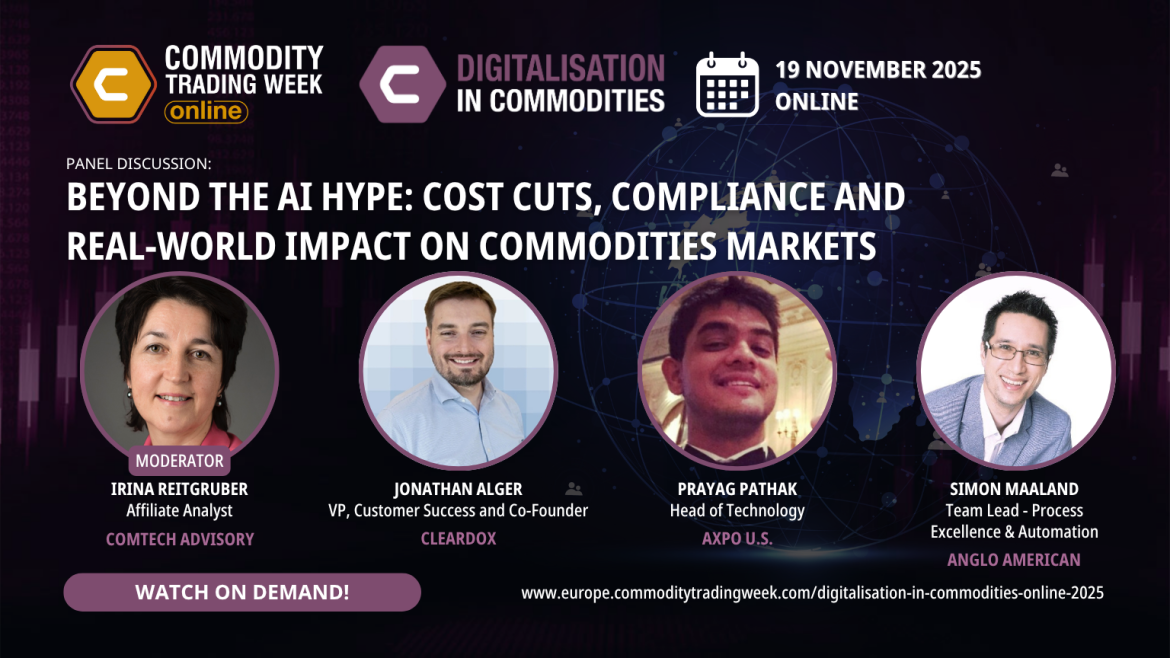

Beyond the AI Hype: Cost Cuts, Compliance and Real-World Impact

AI is reshaping the economics of commodity trading. With deployment costs falling and rollout times accelerating, mid-sized firms now match the digital firepower of the majors. Explore how early adopters scale AI from desk tests to strategy, and how traders navigate new risks from compliance to data bias while unlocking ...

AI in practice: How is AI being used in commodity trading?

This panel discussion explores simulating future scenarios, automating trade entry and documentation, detecting anomalies, and applying machine learning to position and risk management.